Getting My Second Mortgage Vancouver To Work

Table of ContentsWhat Does Home Equity Loan Vancouver Do?Getting My Loans Vancouver To WorkLoans Vancouver Things To Know Before You Get ThisRumored Buzz on Home Equity Loans VancouverThe 15-Second Trick For Second Mortgage VancouverNot known Facts About Second Mortgage VancouverThe Single Strategy To Use For Loans Vancouver

With house equity finances, you're called for to obtain the entire financing quantity in a lump sum, as well as begin paying it off nearly immediately. Individuals occasionally prefer HELOCs because they are extra adaptable if you're not certain exactly how much money you'll wind up needing, yet desire the freedom to take advantage of your line of credit history at any kind of time.As soon as approved, you're assured that amount, as well as you obtain it in full. It provides you accessibility to cash for a collection period of time.

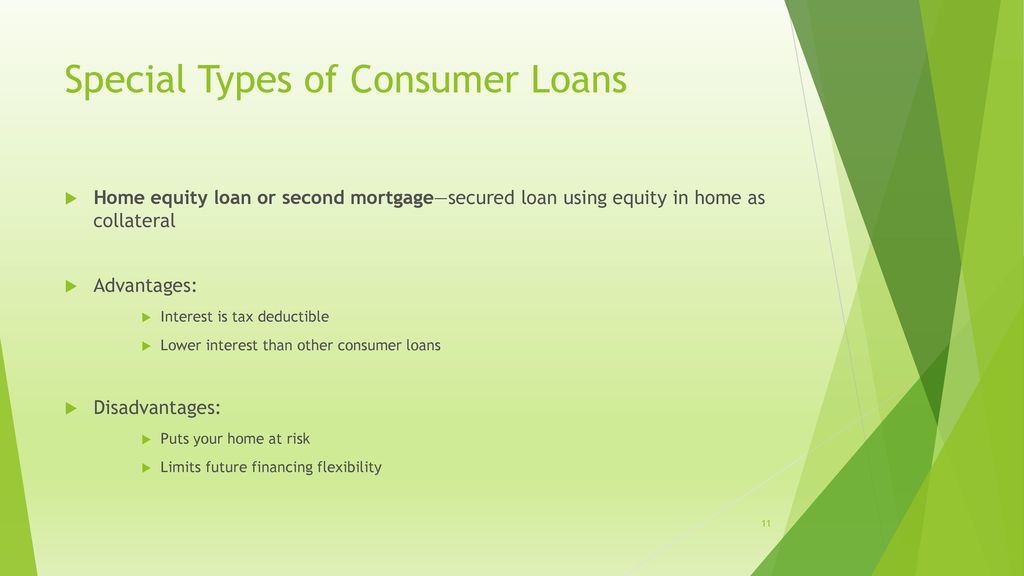

A house equity loan (or bank loan) allows you borrow a swelling sum quantity of money versus the equity in your home on a set rates of interest as well as with repaired month-to-month settlements over a fixed regard to in between 5 as well as twenty years, similar to your very first home mortgage except with a shorter term.

Unknown Facts About Loans Vancouver

You can use the line of credit score for any type of major purchase as well as attract the cash whenever you need it, permitting you to initially only pay interest on the cash you have actually drawn, instead than the complete finance quantity. Home equity financings are commonly made use of to remodel due to the taken care of month-to-month settlements, and reduced set passion rates - however borrowing power is limited by offered house equity.

A Reno, Fi Renovation Residence Equity Funding incorporates the convenience and structure of a traditional house equity financing with the added loaning power of a construction car loan. This design is an excellent choice for lots of house owners, however it is essential to review all of your alternatives before determining what's finest for you.

Perhaps you've listened to that, in many cases, you can deduct the interest paid on house equity loans or credit lines on your tax obligation return? Normally, the rate of interest on these car loans is tax-deductible when: Your finance is protected versus your house - Foreclosure Loans. This is used to accomplish substantial renovations that include value, extends its beneficial life, or adapt it for a new use.

Fascination About Second Mortgage Vancouver

Have a concern - Chat, Email, Call now ... Wondering what to select between a home equity funding vs a home equity credit line (HELOC)? Your search for solutions is over! As your most trusted mortgage broker in Vancouver, we do as much as we can to assist our customers make informed decisions in operation their house equity.

Which one is better for you and your family? Determining to borrow against the equity in your house is not a decision to be taken lightly. The trick to recognizing which one to choose between a residence equity finance vs a residence equity credit line, is thoroughly comprehending the benefits and drawbacks for each one.

How Loans Vancouver can Save You Time, Stress, and Money.

With banks or credit report unions, the credit history restriction you can borrow will click reference be normally restricted by a funding to value and also earnings proportion. Other than for the evaluated worth of your residence, this proportion also takes right into account your income circumstance, credit rating or credit report record. As well as due to the fact that of the COVID-19 pandemic and the resulting monetary shock, banks' authorizations are even harder.

When working with a reliable home loan broker in BC, no various other aspects various other than exactly how much equity you have actually included in residence matter. As well as currently for the ideal part: some of our lenders will not bill you a prepayment penalty in instance you want to pay off your financing in advance of schedule, like most financial institutions typically do.

Most of the times, the tiniest monthly payments will cover the interest throughout the draw duration. However because various lending institutions have various deals, for some HELOCs you will certainly need to pay a big swelling amount at the end. When contrasting the distinctions in between a residence equity car loan as well as a house equity credit line, this kind of finance has one major benefit: versatility.

Unknown Facts About Home Equity Loans Vancouver

So why not contact us today as well as we can review your circumstance comprehensive. We can determine with each other which item is much better suited for you between a house equity car loan vs a residence equity credit line. We can likewise assist you in the direction of the very best loan provider with the most budget friendly conditions.

Your basics equity will be reduced by the amount of the loan, though your equity will certainly change over time, and we will certainly enter into that in more information in this article. Some people think about home equity as being a method to secure fundings, specifically those that assist make improvements to their house, yet there is a lot more to it than that.

You can determine it by taking the appraised worth of your house and afterwards subtracting all car loans that are exceptional versus it. These financings can consist of a mortgage, house equity loan as well as house see it here equity line of credit scores. Allow's say your house has simply been assessed at a worth of $800,000.

6 Simple Techniques For Foreclosure Loans

There are a number of advantages as well as disadvantages of reverse home loans, as well as one of the essential reverse mortgage benefits can have an effect on your home equity. Residence equity reverse home loan customers don't need to make any mortgage repayments, as well as this indicates that the amount they owe boosts every year (because of the annual rate of interest billed) - Foreclosure Loans.

Your house equity would be worth $300,000 today. You benefit from the reverse home mortgage advantages and make no routine home mortgage repayments. Your rate of interest is 4. 65% (this is House, Equity Bank's present three-year fixed mortgage rate in July 2021 subject to transform you can see our current rates below).

The Single Strategy To Use For Home Equity Loans Bc

If home worths boost by 3% this year, your residence would certainly be worth $515,000 in a year's time (over the last 15 years, home worths in Canada enhanced by an average of 6. 4% annually). After a year, your residence equity would be: $515,000 $209,300 = Your home equity would have raised by $5,700, also if you made no mortgage or rate of interest settlements.

As opposed to get a reverse mortgage, they decided to sell their $500,000 house in Ontario and also moved into a $300,000 condo. After paying real estate agent fees, land transfer tax obligation on their brand-new home, elimination expenses and also legal costs, they were entrusted to just over $160,000. They currently had actually the included expense of apartment charges as well as wound up spending their cash after seven years.